Quarterly Report For The Financial Period Ended 31 March 2018

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

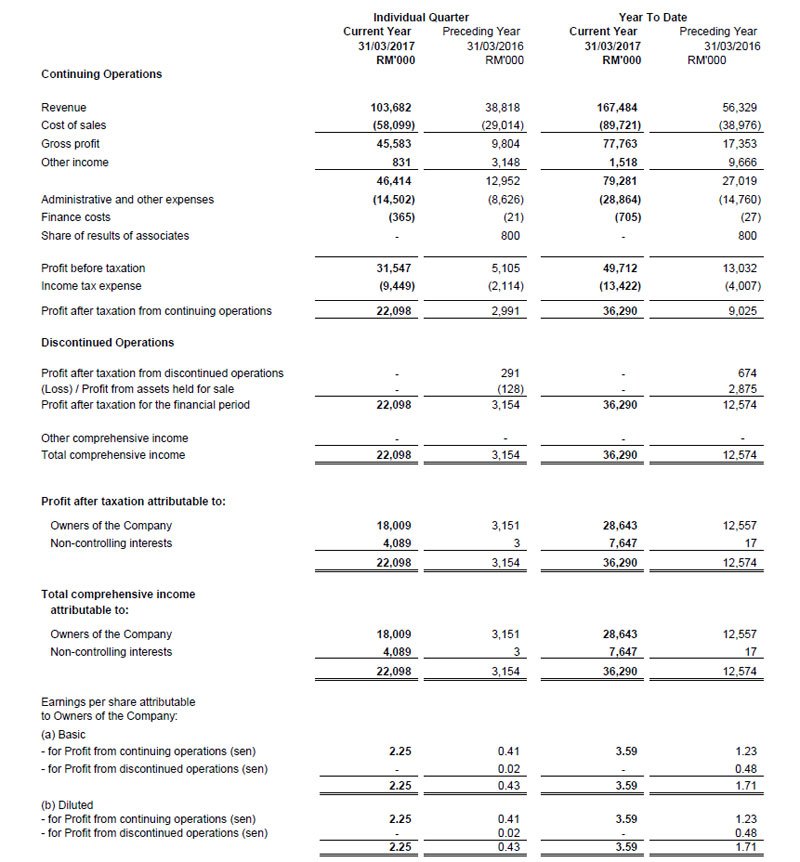

Condensed Consolidated Statement of Comprehensive Income for the Quarter Ended 31 March 2016

Condensed Consolidated Statement of Financial Position

Review of Performance

Quarterly Results

For the current quarter under review, the Group achieved revenue and profit before tax from continuing operations ('PBT') of RM38.82million and RM5.11million respectively, as compared to RM17.07million and RM2.10million recorded in the previous corresponding quarter. The increase in PBT was mainly contributed by the gain from the disposal of shares in a subsidiary.

The segmental performances for the current quarter ended 31 March 2016 are as follows:

Property Development Segment

For the current quarter under review, this segment recorded revenue and total profit before tax of RM38.0million and RM2.43million respectively, as compared to RM12.51million and RM2.99million respectively in the previous corresponding quarter. The lower profit was mainly due to upfront expenses incurred for the Sunsuria City project.

Manufacturing Segment

For the current quarter under review, this segment recorded revenue and total profit before tax of RM4.55million and RM291,000 respectively, as compared to RM3.94million and RM211,000 respectively in the previous corresponding quarter. The profit has improved in the current quarter as compared to the previous corresponding quarter due to improved product profit margin.

This segment had been disposed of on 31 March 2016.

Financial Year-to-date Results

For the 6-month period ended 31 March 2016, the Group recorded revenue and profit before tax from continuing operations of RM56.33million and RM13.03million respectively, as compared to the 6-month financial period ended 31 March 2015 of RM36.05million and RM3.82million in previous year. The higher PBT for the current year has taken into consideration the effects of the disposal of a piece of leasehold land and the disposal of shares in a subsidiary.

The property development segment has generated revenue and total profit before tax of RM54.06million and RM6.87million respectively, as compared to RM27.78million and RM6.84million in preceding quarter. The higher revenue was mainly due to profit contribution from Suria Residence, a serviced apartment project located in Suria Jelutong.

Prospects

For the financial year ending 30 September 2016, the Group recognises that the outlook remains challenging due to the weak market condition.

However, barring unforeseen circumstances, the Group is confident to deliver an improved performance as the property development business will continue to drive the growth of the Group, premised on the prime location of existing land banks and the right product mix with the right pricing strategy.